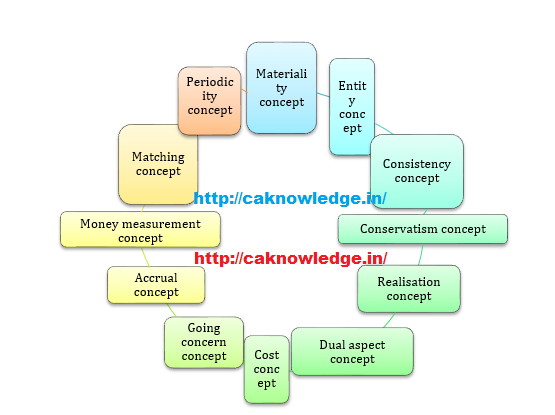

(1) Entity concept :

Entity concept assumes that business Enterprise is separate from its owners. Accounting transactions should be recorded with this concept only. The main intention of this concept is to keep the business transactions keep away from the influence of personal transactions of its owners.

(2) Periodicity Concept :

As per going concern concept an entity is assumed to have indefinite life. If we want to measure the financial performance of an entity then we need to divide the operations of entity for a specific period, otherwise it’s very difficult to ascertain the performance of business. Periodicity concept assumes a small but workable fraction of time period for measuring the business performance. Generally it assumes 1 year is taken for this purpose.

(3) Money measurement concept :

As per this concept transactions which can be measured in monetary terms only are to be recorded in books of accounts. Any transactions which can not be converted into monetary terms should not be recorded in books. Since money is the medium of exchange and unit of measurement for showing the financial performance , it doesn’t accept the transactions other than monetary to record in books of accounts.

(4) Accrual concept :

As per this concept transactions should be recognized in the books of accounts only when they occur and not on any cash basis. The main advantage of this concept is that financial Statements prepared as per this concept inform the users not only about past events involving payment and receipt of cash but also about obligations to pay cash in the future and resources that represent cash to be received in the future.

(5) Matching concept :

As per this concept all the expenses which can be matched with the revenue of that period only should be taken into consideration for financial reporting. This concept is based on Accrual concept as it gives importance to occurrence of an expense which is spent for generating a revenue. This concept leads to adjustments at the end like outstanding expenses, income and Prepaid expenses , incomes.

(6) Going concern concept :

As per this concept financial statements are prepared on an assumption that enterprise will continue its operations for the foreseeable future. Thus, it says that enterprise has neither the intention nor the need to liquidate or curtail the scale of its operations. Valuation of assets of a business entity is dependent on this assumption.

(7) Cost concept :

As per this concept valuation of assets should be done at historical costs/acquisition cost.

(8) Realisation concept :

This concept says that any change in value of an asset is to be recorded only when the business relaises it. This concept highly prefers Realisation of the value for which we want to give effect in books of accounts.

(9) Dual Aspect concept :

This concept is base for double entry Accounting.s of a transaction. Under the system, aspects of transactions are classified into two main types:

DebitCredit

Every transaction should have a Debit and credit. Debit is the portion of transaction that accounts for the increase in assets and expenses, and the decrease in liabilities, equity and income. And credit is the portion which is a results of decreases the asset, increases the liability, income, gains, equity.

Accounting conventions:

Accounting conventions are the generally accepted guidelines in preparation of financials.They arise from customs and practical application.They are not legally documented policies.

Following r the accounting conventions

(1) Conservatism : As per this concept while Accounting one should not anticipate the income but should provide for all possible losses. When there are many alternative values to account an asset then we should choose the lesser value. Inventory valuation is done as per this concept only , as cost or Market value which ever is lower. (2) Consistency : As per this concept the accounting policies followed in preparation and presentation of financial statements should be consistent from one period to another period. A change in Accounting policy can be made only when it is required by law , or for better presentation of accounts or change in Accounting standards. (3) Materiality : As per this concept items having significant economic effect on the business of the enterprise should be disclosed in financial statements and any insignificant item which is not relevant to the users should not be disclosed in financial statements. Recommended Articles

Double entry systemWhat is Debit and credit explainedBasic Principles and Golden Rules of AccountingWhat is an Account & Types of Accounts Accounting Standard 13