Accounting Standard 1 (AS 1)

1. Meaning:

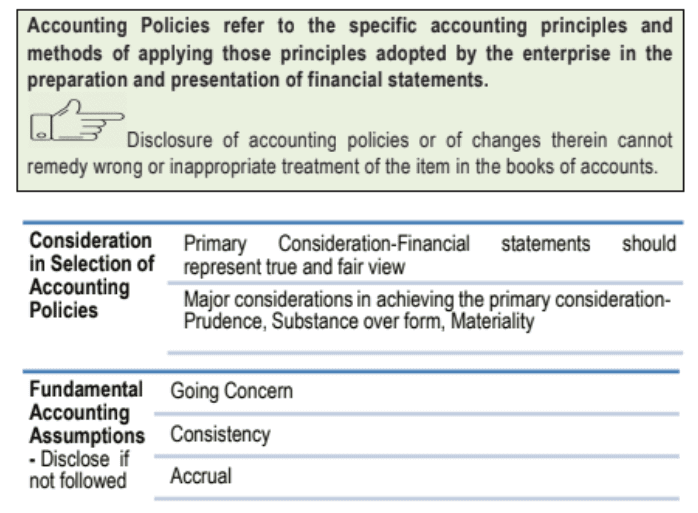

Accounting policy refers to specific accounting principles and methods of applying those principles in preparation and presentation of financial statements.

Change in an Accounting Policy

Disclose change which has material effect in the current period or is reasonably expected to have material impact in later periods.In case of change which has material effect in the current period, disclose, to the extent ascertainable, the amount by which any item in the financial statements is affected by such change.If not ascertainable, wholly or in part, indicate the fact.

2. Conditions to be satisfied for adopting accounting policy :

(a) Prudence :

A (conservatism) probable loss is to be recognised but probable income is not to be recognised unless it is virtually certain.Inventories are valued at cost or net realisable value whichever is lower.Probable loss on completion of a contract is to be provided immediately.

(b) Substance: Is more important than form. Transactions and other events should be accounted for and presented in accordance with their substance and financial reality not merely with their legal form. Example: depreciation is allowed to the lessee even though he is not the owner0. (c) Materiality:

All material facts which are necessary are to be satisfied.Facts which are not of material nature need not be disclosed separately.

3. Why the standards are issued?

Different enterprises are following different accounting policies .so we can’t give meaning full comparison between enterprises.All accounting policies must be disclosed.They must be disclosed at one place instead of being scattered all over the pages.

4. When separate discloser is not required?

If an enterprise adopt the following fundamental accounting assumptions separate disclosure that they are followed is not necessary. (a) Going concern: The enterprise is a continuing concern not to be liquidated nearby future. (b) Consistency in policies : The enterprise is following the same accounting policies from time to time (c) Accrual method: Expenses and incomes are recognised as and when they are incurred irrespective of actual cash payments Example: outstanding incomes and expenses should be taken into account while preparing financial statements.

5. Change in accounting policy :

Any change in accounting policy should be disclosed.The effect of such a change should be quantified.If quantification is not possible the facts should be disclosed.The change is to be disclosed in the year or years in which it has an impact on financial statements.

Example: Change in method of depreciation. Change in the method of valuation of inventories.

6. Which enterprises the standards do not apply?

The standards do not apply to an enterprise which is not of a commercial nature (non-profit enterprise) For example: charitable institutions and cooperative societies etc. Note: it the enterprise has any part which is of a commercial nature the standards apply in total to the entire enterprise.

7. Conflict:

When there is a conflict between an accounting standard and a statutory requirement then the statue will prevail over the accounting standard. For example: valuation of fixed assets when a loan is taken in foreign currency to purchase that fixed asset.

8. Applicability of accounting standards :

CompaniesOther than companies

(a) Companies: Authority- NACAS (national advisory committee on accounting standards) Non small & medium company (non SMC)

Enterprises which are listed in stock exchange in India or outside India or in the process of listing.The companies are bank or financial institution or insurance company.The company turnover is more than 50 crores in the immediately preceding accounting year.The company have borrowings including public deposits exceeding 10 crores at any time during the immediately preceding accounting year.The company is a holding company or subsidy of non SMC.All accounting standards from 1 to 29 are applicable in full.

Small &medium company (SMC): Other than non SMC Application of accounting standards:

Full exemption – AS 3,17Partial exemption- AS 15, 19,20,28,29.Not applicable due to legal reason – AS 21,23,25,27.Other are applicable in full

(b) Other than companies : Authority – ICAI Level – I

Enterprises which are listed in stock exchange in India or outside India or in the process of listing.The companies are banks including co-operative societies or financial institution or insurance company.The company turnover is more than 50 crores in the immediately preceding accounting year.The company have borrowings including public deposits exceeding 10 crores at any time during the immediately preceding accounting year.The company is a holding company or subsidy of non SMC.All accounting standards from 1 to 29 are applicable in full.

Level -II

The companies turnover for the immediately preceding accounting period on the basis of audited financial statements exceeds 1 crores but does not exceed 50 crores. Turn over does not include other income.The company have borrowings including public deposits excess of 1 core but not excess of 10 crores at any time during the accounting period.Holding and subsidiary enterprises of any one of the above at any time during the accounting period.

Application of accounting standards:

Full exemption – AS 3,17Partial exemption- AS 15, 19,20,28,29.Not applicable due to legal reason – AS 21,23,25,27.Other are applicable in full

Level –III Other than levels I and II Application of accounting standards:

Full exemption – AS 3,17,18,24Partial exemption- AS 15, 19,20,28,29.Not applicable due to legal reason – AS 21,23,25,27.Other are applicable in full

Recommended Articles

Accrued LiabilitiesAccounting Entries for Service Tax, VAT and TDSVarious Types of Vouchers In AccountingSubsidiary Books And Their AdvantagesAccounting for Not for Profit OrganisationInternal Rate of ReturnNet Present Value (NPV)