GST is a single tax on the supply of goods and services, right from the manufacturer to the consumer. Credits of input taxes paid at each stage will be available in the subsequent stage of value addition, which makes GST essentially a tax only on value addition at each stage. The final consumer will thus bear only the GST charged by the last dealer in the supply chain, with set-off benefits at all the previous stages. in this article we provide complete details for “Benefits of GST in India” Check more details from below…..

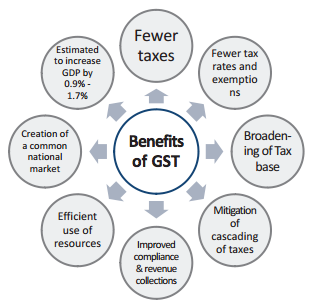

Benefits of GST in India

(A) Make in India:

(i) Will help to create a unified common national market for India, giving a boost to Foreign investment and “Make in India” campaign;(ii) Will prevent cascading of taxes as Input Tax Credit will be available across goods and services at every stage of supply;(iii) Harmonization of laws, procedures and rates of tax;(iv) It will boost export and manufacturing activity, generate more employment and thus increase GDP with gainful employment leading to substantive economic growth;(v) Ultimately it will help in poverty eradication by generating more employment and more financial resources;(vi) More efficient neutralization of taxes especially for exports thereby making our products more competitive in the international market and give boost to Indian Exports;(vii) Improve the overall investment climate in the country which will naturally benefit the development in the states;(viii) Uniform SGST and IGST rates will reduce the incentive for evasion by eliminating rate arbitrage between neighboring States and that between intra and inter-State sales;(ix) Average tax burden on companies is likely to come down which is expected to reduce prices and lower prices mean more consumption, which in turn means more production thereby helping in the growth of the industries. This will create India as a “Manufacturing hub”.

(B) Ease of Doing Business:

(i) Simpler tax regime with fewer exemptions;(ii) Reduction in multiplicity of taxes that are at present governing our indirect tax system leading to simplification and uniformity;(iii) Reduction in compliance costs – No multiple record keeping for a variety of taxes- so lesser investment of resources and manpower in maintaining records;(iv) Simplified and automated procedures for various processes such as registration, returns, refunds, tax payments, etc;(v) All interaction to be through the common GSTN portal- so less public interface between the taxpayer and the tax administration;(vi) Will improve environment of compliance as all returns to be filed online, input credits to be verified online, encouraging more paper trail of transactions;(vii) Common procedures for registration of taxpayers, refund of taxes, uniform formats of tax return, common tax base, common system of classification of goods and services will lend greater certainty to taxation system;(viii) Timelines to be provided for important activities like obtaining registration, refunds, etc;(ix) Electronic matching of input tax credits all-across India thus making the process more transparent and accountable.

(C) Benefit to Consumers:

(i) Final price of goods is expected to be lower due to seamless flow of input tax credit between the manufacturer, retailer and supplier of services;(ii) It is expected that a relatively large segment of small retailers will be either exempted from tax or will suffer very low tax rates under a compounding scheme- purchases from such entities will cost less for the consumers;(iii) Average tax burden on companies is likely to come down which is expected to reduce prices and lower prices mean more consumption.

Mitigation of cascading taxation:

Since under the GST Regime, credit will be available across the largely online procedures will lead to improved tax compliances with lesser scope for mistakes. Increased compliances together with a wider tax base will eventually boost the tax revenues. entire supply chain there will be no cascading of taxes and the issues under the existing system like tax payable on tax (e.g. VAT is payable on excise duty) will be suitably addressed. Thus, in due course of time, GST will lower the prices of goods and benefit the common man. The major advantage of GST to market place players is that it will remove the restrictions on cross utilisation of credits. Currently, traders are denied credit of service tax paid on input services such as warehousing, logistics, commission of marketplace and service providers are not allowed to claim credit of VAT paid on goods that are used for providing output services. This cascading results in a significant blocked input tax cost for this sector since VAT is applicable on the output side, whereas most input costs are services. The GST model will therefore facilitate seamless credit across supply chains, with tax set offs available across the production value-chain, both for goods and services. This will result in reduction of cascading effect of taxes, therefore bringing down the overall cost of supplies. It is hoped that this cost benefit would be ultimately passed on to the customers or help in increasing the profits of the companies

Elimination of multiple taxes and double taxation:

GST will subsume majority of existing indirect tax levies both at Central and State level into one tax i.e., GST which will be leviable uniformly on goods and services. This will make doing business easier and will also tackle the highly disputed issues relating to double taxation of a transaction as both goods and services. Currently, there are differential rates of VAT for the same goods in different States. There are a lot of classification disputes in current scenario. However, GST rates at both the Central and State level are expected to be uniform and harmonised which would drastically reduce disputes among tax authorities and e- commerce players. For e-commerce companies, which are forefront in the startup boom in the country, the regime is likely to increase the compliance burden. Sandeep Ladda of PwC says that since the GST is a destination tax, the compliances will be the e-commerce website’s responsibility and not the sellers’. So the work for these companies will increase.

Creation of unified national market:

The existing indirect tax structure has disintegrated the Indian market into 29 state markets by creating tax barriers. Such artificial fences in the economy hamper efficient production and supply chain models and curb trade. GST will create unified national market which would facilitate free movement of goods and services across the country. This will help in removing economic distortions, promote exports and give a boost to India’s tax-to-gross domestic product (GDP) ratio. According to a Study conducted by the National Council of Applied Economic Research [December 2009] for 13th Finance Commission to assess the impact of GST on India’s Growth and International trade, GST is expected to increase the country’s GDP somewhere within a range of 0.9%-1.7%

Increase in voluntary compliance and tax revenues:

As GST will do away with multiplicity of taxes, it will ensure a simpler tax regime with fewer taxes, rates and exemptions. A simplified tax regime coupled with simple, articulate and largely online procedures will lead to improved tax compliances with lesser scope for mistakes. Increased compliances together with a wider tax base will eventually boost the tax revenues. Recommended Articles

Why GST For India – Challenges for Success in IndiaRole of Chartered Accountants in GSTIntroduction of GSTGST DefinitionGST Current Structure and proposed GST RegimeFiling of GST ReturnsGST FormsGST RatesGST Registration