The Institute of Chartered Accountants of India (ICAI) has formulated the Revised Scheme of Education and Training in lines with International Education Standards issued by International Federation of Accountants (IFAC) after considering the inputs from various stakeholders. The Revised Scheme of Education and Training for CA course will come into effect from 1st July, 2017. Now check more details for CA IPCC Course 2017 from below…..

Important Dates & CA IPCC New Course, Syllabus, Applicability

IPCC & CA Intermediate Parallel attempts

So last attempt for CPT Students is Nov 2019

CA Intermediate Course, IPCC New Course

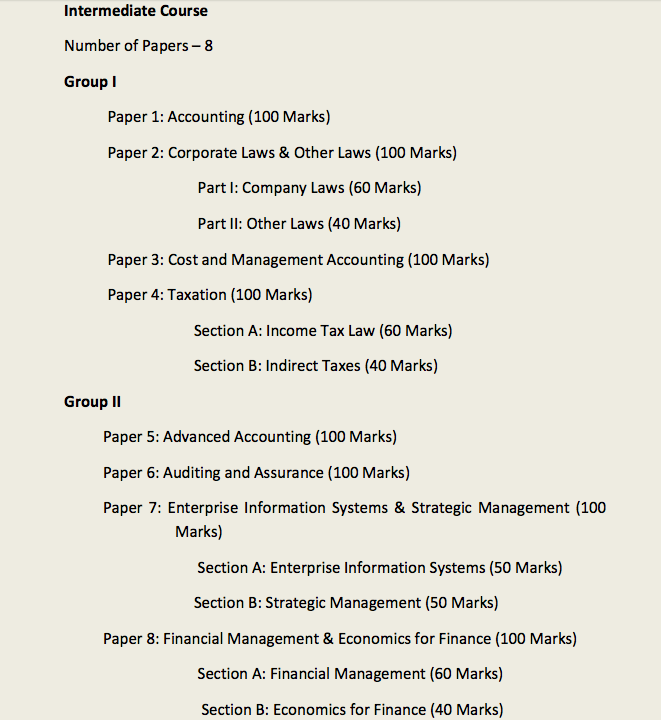

Number of Papers – 8 Group I Paper 1: Accounting (100 Marks) Paper 2: Corporate Laws & Other Laws (100 Marks)

Part I: Company Laws (60 Marks)Part II: Other Laws (40 Marks)

Paper 3: Cost and Management Accounting (100 Marks) Paper 4: Taxation (100 Marks)

Section A: Income Tax Law (60 Marks)Section B: Indirect Taxes (40 Marks)

Group II Paper 5: Advanced Accounting (100 Marks) Paper 6: Auditing and Assurance (100 Marks Paper 7: Enterprise Information Systems & Strategic Management (100 Marks)

Section A: Enterprise Information Systems (50 Marks)Section B: Strategic Management (50 Marks)

Paper 8: Financial Management & Economics for Finance (100 Marks)

Section A: Financial Management (60 Marks)Section B: Economics for Finance (40 Marks)

CA Intermediate Fees

No information available at this time, keep visit to this page to get all updates for CA Intermediate New Course

CA Intermediate Registration

CA Intermediate Course registration is start from 1st July 2017 and First attempt is held on May 2018 Please Note – If any student is registered before 1st July then he is eligible for IPCC Course (Old Course) Practical Training (Articleship Training)

Duration of Practical Training: Three YearsCommences after completing Integrated Course on Information Technology and Soft Skills (ICITSS) and passing either or both groups of Intermediate.For direct entrants coming through Graduation and Post Graduation route, the practical training commences immediately after they complete four weeks ICITSS.For direct entrants who have passed Intermediate level examination of Institute of Company Secretaries of India or Institute of Cost Accountants of India, the practical training commences immediately after completing Integrated Course on Information Technology and Soft Skills (ICITSS) and passing either or both groups of Intermediate

Advance Four Weeks Integrated Course on Information Technology and Soft Skills (AICITSS) (in replacement of General Management and Communication Skills(GMCS) & Advanced Information Technology Training) Duration: 4 weeks (2 weeks for soft skills and 2 weeks for Advance IT) When to complete: Students undergoing Practical training shall be required to do AICITSS during the last 2 years of Practical training but to successfully complete the same before being eligible to appear in the Final Examination. The students will be tested on “Information System Risk Management and Audit” under AICITSS. The students would be tested through online test paper/ OMR Test Paper conducted by the examination department which they would be required to qualify to be eligible to appear for Final Examination. Recommended Articles If you have any query regarding “CA IPCC New Course, Syllabus, Applicability” then please tell us via below comment box…