Case Law – Vodafone Case Vs Income Tax Department

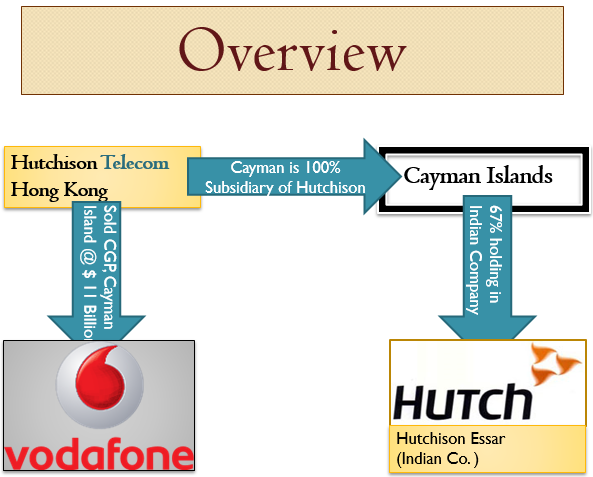

Vodafone India, formerly Vodafone Essar and Hutchison Essar, is the Second largest mobile network in India . Vodafone India launched 3G Services in the country in January – March quarter of 2011 and plans to spend up to $500 million within 2 years on its 3G network.

A Fight Over Jurisdiction

Two issues arise on sale of CGP shares

Whether HTIL by reason of instant transaction ,had earned income liable for capital gains tax in India as this income was earned towards sale consideration in India as a group in favour of vodafone.Whether , on payment made by the vodafone to HTIL on such transaction , vodafone was liable to deduct tax at source u/s 195 from sale consideration paid to HTIL.

Tax Authority’s Contention

Tax Authority contended that the transfer of a single share in CGP to Vodafone resulted in the transfer of HTIL’s interests in Vodafone Essar Ltd to VodafoneIn addition to transfer of the share, other rights and entitlements were transferred as an intrinsic part of the transaction.Thus it initiated proceedings against Vodafone for a failure to deduct tax u/s 195 seeking to recover $2.1 billion from Vodafone as alleged withholding tax liability.

Vodafone’s Plea

The provisions were not applicable to the current case & the primary obligation to discharge the tax with the payee (HTIL)Unless the payee had defaulted in making payment of taxes , on demand by the revenue authorities , tax could not be recovered from the payerThe withholding tax provisions cannot have extra –territorial application i.e. cannot apply in an offshore transaction involving two non-residents in respect capital asset & payment outside India. the transaction was not chargeable to tax India since it involves transfer of shares of a non-resident company by one non-resident to another & is not a transfer of capital asset in India.

Bombay High Court Decision

High Court Dismissed the petition of Vodafone BV & accepted that the transaction had a significant nexus with India and proceedings initiated by it cannot be held to lack Jurisdiction Key Observations :

Tax planning is legitimate so long as the assesses does not resort to a colorable device or a sham transaction with a view to evade taxes;A controlling interest which a shareholder acquires is an incident of the holding of shares and has no separate or identifiable existence distinct from the shareholding

Conclusions :

The essence of the transaction was a change in the controlling interest in HEL which constituted a source of income in India.Accordingly, Indian Tax Authorities have acted within their jurisdiction in initiating the proceedings against the Petitioner for not deducting tax at source. The provisions of S. 195 would operate

Supreme Court’s Decision

Supreme Court held that situs of shares situates at the place where the company is incorporated and / or the place where the shares can be dealt with by way of transfers. Thus the situs of shares of CGP is not in India. Section 9 covers only income arising from a transfer of a capital asset situated in India; it does not purport to cover income arising from the indirect transfer of capital asset in India Section 195 would apply only for payments made from a resident to a non-resident, and not between two non-residents situated outside India. In the instant case, the Hon’ble Court observed that the transaction was between two non-resident entities through a contract executed outside India. Consideration also passed outside India. The transaction has no nexus with the underlying assets in India It involves transaction between two non-residents in respect of shares of a company incorporated outside India. Therefore, the Indian Tax Authorities have no territorial tax jurisdiction over the said transaction Supreme Court held that since the capital gains was not taxable in India, Vodafone was not required to deduct TDS on the said capital gains.

Impact

As a result Vodafone was having a obligation to Pay Rs. 20000 Crores.These amendments will take effect retrospectively from 1st April , 1962 and will accordingly apply in relation to the assessment year 1962-63 and subsequent assessment years

Prepared By – CA Sanjay Assudani Download Presentation on Vodafone case