In this article you can complete details for Convertible debentures and Non Convertible Debentures like – Benefits or advantages of Convertible Debentures, Disadvantages of Convertible Debentures, Benefits for Non Convertible Debentures, Disadvantages Non Convertible Debentures (NCD), Review of Non Convertible Debentures etc. Now you can scroll down below and check difference between Convertible and Non Convertible Debentures. Based on the ability to convert the debentures after certain period of time in to shares, they are said to be of 2 types as:

Convertible debenturesNon – convertible debentures.

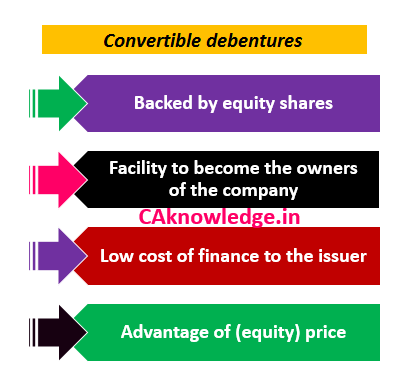

1. Convertible debentures:

Debentures which facilitate the owner of these instruments to convert them into shares after a particular period of time are known as convertible debentures.

Benefits:

Since they are backed by a facility of converting into equity, at the times of conversion if the market value of that particular company’s equity is doing well then it will give a huge return.As they carry lower rate of interest compared to non – convertible debentures, cost to the issuer is comparatively low.Along with the performance of the equity in the financial markets the rate of interest and the demand for these convertible debenture fluctuates often. One can take the price advantage when the equity is on increasing trend.

Disadvantages:

Unlike non – convertible debentures these are not backed by any assets of the issuer agency. They are secured only by the equity of the company which is highly vulnerable. Thus they are less secured comparativelyA major disadvantage for the issuing company is that convertible debentures bring the risk of diluting the EPS of the company’s common stocks, and also the control of the company.Investors of these bonds usually receive substantially lower yield to maturity in comparison to the non-convertible bonds.

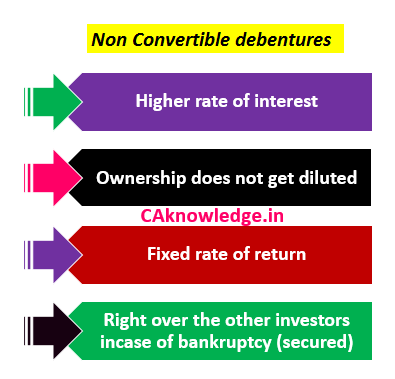

2. Non Convertible Debentures:

Debentures which cannot be converted into equity are known as non – convertible debentures.

Benefits:

They carry a good rate of return when compared to convertible debentures.Non – convertible debentures (secured) are backed by the assets of the company. So in the case of financial bankruptcy the holders of these instruments have an overriding right in claiming the proceeds of the assets of the issuer.To the issuer the major advantage is that the ownership does not get diluted. Hence his (shareholders) control remains same on the company.Unlike convertible debentures these offer a fixed rate of interest whereas the rate of interest earned by the convertible debentures is highly affected by the performance of the equity in the market.

Disadvantages:

Their inability to get them converted into equity does not give a facility to become the owners of the company by becoming a shareholder.The rate of interest in higher than that is paid on convertible debentures which is disadvantage to the issuer.In case of unsecured non – convertible debentures they will be at very high risk at the times of bankruptcy in realizing the claims from the proceeds of the assets of the company which are reserved to the secured instruments.

Recommended Articles

Accrued LiabilitiesAccounting Standard 15Various Types of Vouchers In AccountingSubsidiary Books And Their AdvantagesCA Final ResultCA IPCC ResultUnderstanding The Process of Debt SecuritizationMaterial RequisitionConcept Determining Working Capital Requirement