If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “ Recommended Articles

Form 16 TDSWhat is FrankingVarious Due Dates For Indian TaxesProcedure for Re-issue of Income tax RefundIncome Tax Slab RatesList of All Incomes Exempt from Income TaxPAN Name By PAN NoHow to submit Response for Outstanding Tax Demand

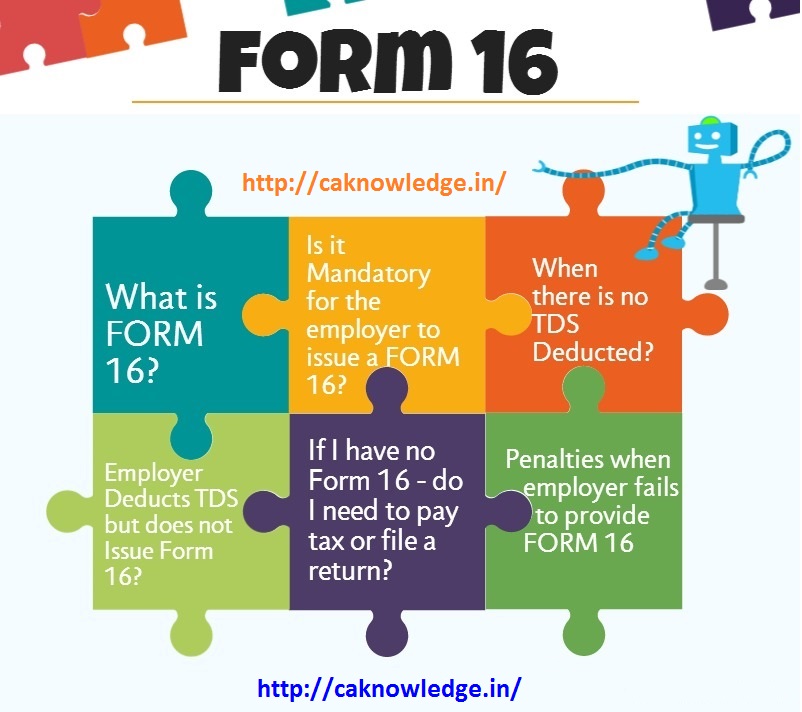

Features and Important Components of Form 16

Features of Form 16

The following features make Form 16 an important part of the entire process of filing Income Tax Returns in India. The Form is especially important to Employees working in a company or firm.

It is applicable to Salaried personnelIt is a Tax Deduction at Source (TDS) Certificate issued by the EmployerIt acts as proof that the Employer has deducted TDS while paying the EmployeeIt is proof of the Salary that the Employee receivesIt reflects the amount of Income Tax paid by the Employer on behalf of the EmployeeIt can be used by the Employee as proof of his Income if the Income Tax Department wishes to scrutinize the Income Tax Returns in detailOnly an Employer with a TAN (Tax Deduction Account Number) is eligible to deduct TDS, and therefore issue a Form 16If TDS is not deducted the Employer is not under obligation to issue a Form 16 to the EmployeeIf TDS is deducted, the responsibility to issue the Form 16 to the Employee lies with the EmployerInformation given on a Form 16 can be corrected.

Important Components of Form 16

Following are few key components that are found in a Form 16

Personal details of the Employee including Name, Permanent Account Number (PAN) etc.Employer details including Name, permanent account number PAN, TAN etc.Acknowledgement Number of the Income Tax Payment made by the EmployerDetails of Salary including Gross Salary, Net Salary, Perquisites, Deductions etc.Total Income and Total Tax deductedDetails of Education Cess or Surcharge etc.Tax deducted as per Section 192 (1A)Receipt Number of the TDS PaymentBalance Tax Payable by the Employee or Refundable to the EmployeeDetails of Tax Payment including Cheque Number, DD Number, Voucher Number, Challan Number etc.Declaration of Tax Payment by the Employer

Download Form 16 in Excel and PDF Utility

Download Form 16 with tax calculation formulas for AY 2017-18Download Form 16 for AY 2016-17 (FY 2015-16) In ExcelDownload Form 16 for AY 2014-15Download Form 16 for FY 2014-15 (AY 2015-16)