If you like this article then please like us on Facebook so that you can get our updates in future ……….and subscribe to our mailing list ” freely “

How to Pay TDS Online Full Guide and Procedure

You Can Also View this Video If You Don’t Understand Exact Procedure

How to Pay TDS Online Full Guide and Procedure

Open Google Search EngineNow Enter – www.tin-nsdl.comOpen TIN-NSDL WebsiteSelect E-Payment to Taxes on right hand side

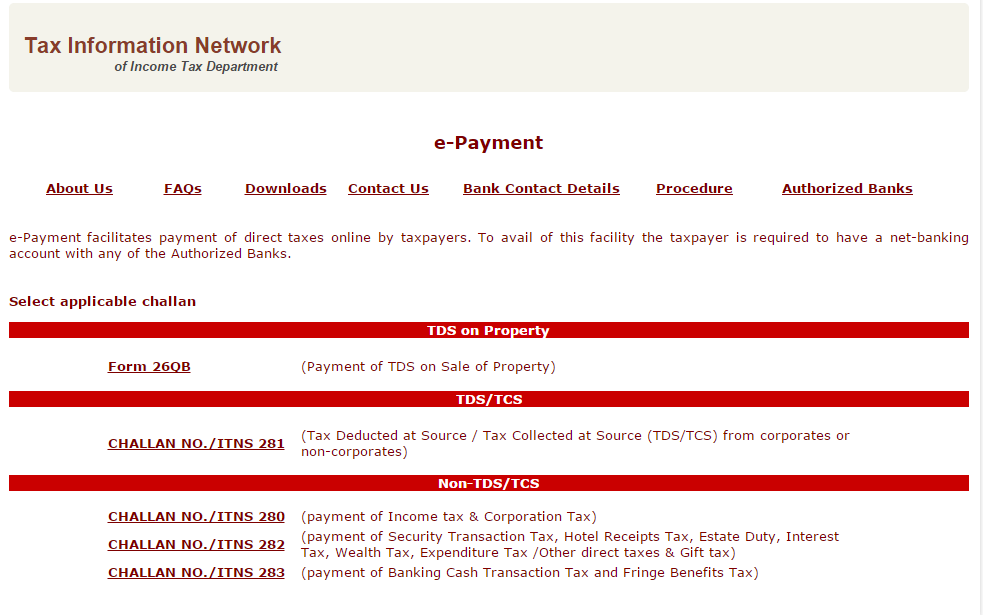

Now You Can See Next Screen i.e Tin-Nsdl E-payment WebsiteYou Can Direct Open This Website By Click on Following Linkhttps://onlineservices.tin.egov-nsdl.com/etaxnew/tdsnontds.jspNow Click here to “Click to pay tax online“Now You can See Following Screen in Your Browser

Now You can Click On Challan No./ITNS 281(Tax Deducted at Source / Tax Collected at Source (TDS/TCS) from corporates or non-corporates)Now You can See Following Screen in Your Browser

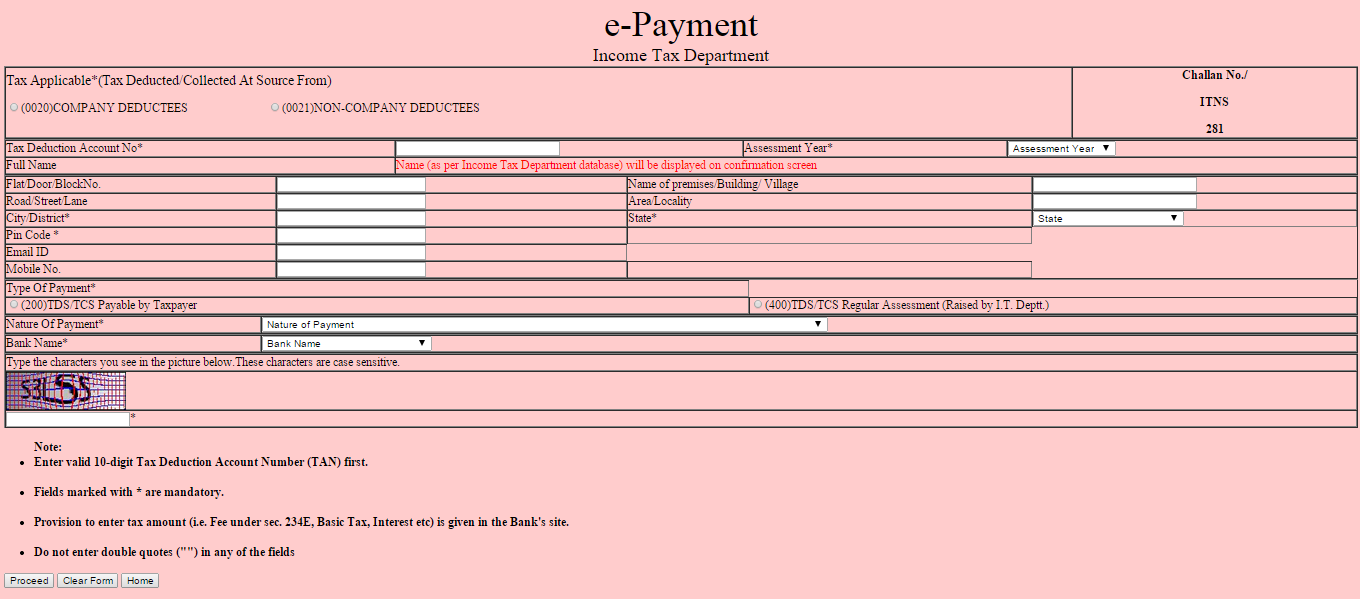

Now You can Fill all the Entries and Click on Process Button Like

Enter Address and State must.Select Type of payment as (200)Select correct nature of paymentie., Rent, Contract, Professional Expenses etc.Select Bank from which you are making paymentEnter the case sensitive characters in the box givenIn the next screen confirm the name displayed and financial year.After you confirm all the details click proceed for online payment and preserve the challan for E TDS Filing.

Thanks For View this Article. I Hope This Article is Helpful for Online TDS Payment. If You Have any Query Please Tell us Via Comment Box we try to solve Your Query Instantly. Recommended Articles

Complete Details for TDS on RentDownload Form 3CA 3CB 3CD In Word Excel & Java FormatDeduction For Donation Under Section 80GDeduction For Medical Insurance Premium U/Sec 80dProcedure For E-Filling of Tax Audit ReportCalculation and Taxability of House Rent Allowance (HRA)Depreciation Rate Chart As Per Companies Act 2013