(a) use in the production or supply of goods or services or for administrative purposes; or(b) sale in the ordinary course of business.

List of other IndAS

Ind AS 40 Investment Property

Objective Objective of this standard is to prescribe the accounting treatment for investment property and related disclosure requirement. The critical areas that deserve special attention are :

Exercising judgment in the determination of whether or not a property qualifies to be classified and accounted for as Investment propertyReclassification of assets, into and out of the category of investment propertyExtensive disclosures

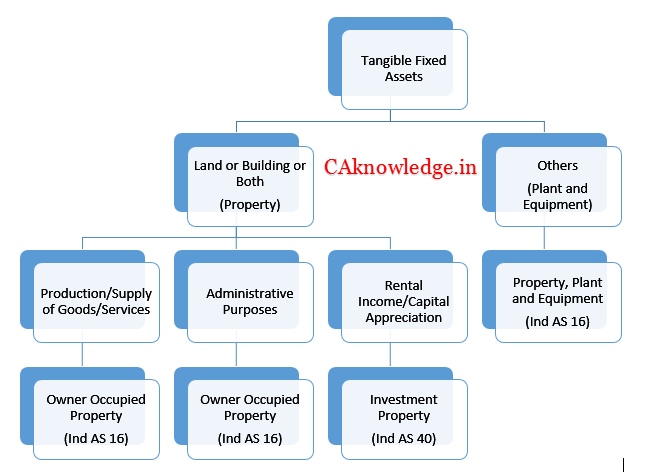

Owner-occupied property : (Ind AS 16) Owner-occupied property is property held (by the owner or by the lessee under a finance lease) for use in the production or supply of goods and services of for administrative purposes. Investment property : (Ind AS 40) Investment property is property (land or a building – or part of a building – or both) held (by the owner or by the lessee under a finance lease) to earn rentals or for capital appreciation or both, and not held for, (a) Use in the production or supply of goods of services or for administrative purposes or (b) Sale in the ordinary course of business

Classification of Property

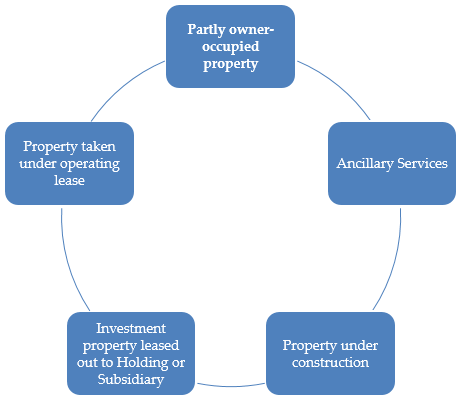

Classification issues

Recognition (Paragraph 16)

An Owned investment property shall be recognised as an asset when, and only when:

(a) it is probable that the future economic benefits that are associated with the investment property will flow to the entity; and(b) the cost of the investment property can be measured reliably.

Measurement (Paragraph 20)

An owned investment property shall be measured initially at its cost. Transaction costs shall be included in the initial measurement. An investment property held by a lessee as a right-of-use asset shall be measured initially at its cost in accordance with Ind AS 116. When a lessee measures fair value of an investment property that is held as a right-of-use asset, it shall measure the right-of-asset, and not the underlying property at fair value.

Measurement after recognition

The Standard permits an entity to adopt as its accounting policy the cost model prescribed in paragraph 56 of the Standard to all of its investment property. However, the Standard requires all entities to measure the fair value of investment property, for the purpose of disclosure. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. (See Ind AS 113, Fair Value Measurement).

Cost Evaluation

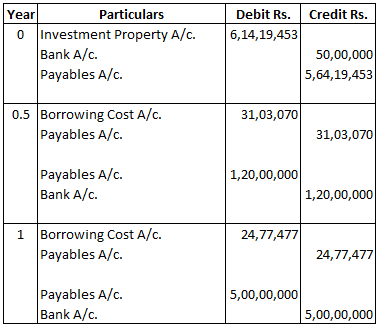

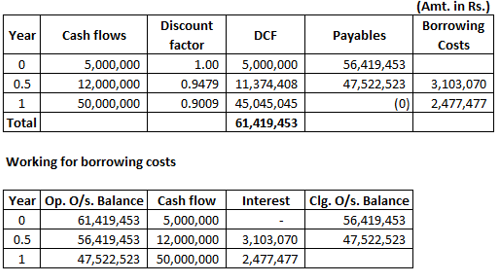

Acquisition of Investment property on deferred payment Cost of day-to-day servicing may include primary cost of labour and consumables, and may include the cost of minor parts i.e. Repair & Maintenance, these costs are to be recognised in P&L as incurred If payment for an investment property is deferred, its cost is the cash price equivalent. The difference between this amount and the total payments is recognised as interest expense over the period of credit Example : X Ltd. acquired an investment property under defer payment plan: Down payment on date of acquisition Rs. 50,00,000 After 6 months Rs. 1,20,00,000 After 1 year Rs. 5,00,00,000 The incremental borrowing rate of the company is 11%. What is the cost of investment property at initial recognition? How should X Ltd. account for the difference? Solution : Workings Measurement of property acquired in exchange transaction

If the fair value of the asset received in more clearly evident, then the entity recognises the investment property at its fair value at initial recognition.Otherwise, it is measured at fair value of the asset given up.If the acquired asset is not measured at fair value, its cost is measured at the carrying amount of the asset given up.

Transfer i.e. Change in Use (Paragraph 57) Transfers to, or from, investment property shall be made when, and only when, there is a change in use, evidenced by:

Commencement of owner-occupation, for a transfer from investment property to owner-occupied property;Commencement of development with a view to sale, for a transfer from investment property to inventories;End of owner-occupation, for a transfer from owner-occupied property to investment property; orCommencement of an operating lease to another party, for a transfer from inventories to investment property.

Disposals (Paragraph 66) An investment property shall be derecognised (i.e. eliminated from the balance sheet) on disposal or when the investment property is permanently withdrawn from use and no future economic benefits are expected from its disposal. Gains or losses arising from the retirement or disposal of investment property shall be determined as the difference between the net disposal proceeds and the carrying amount of the asset and shall be recognised in profit or loss (unless Ind AS 17 requires otherwise on a sale and leaseback) in the period of the retirement or disposal. Disclosure(Paragraph 75) An entity shall disclose:

Accounting policy for measurementCriteria for classificationFair valuation of investment property by a qualified independent valuerAny amount recognised in Profit or Loss for: i.rental income ii.direct operating expenses iii.restrictions on realisability of remittance of income and proceeds of disposal iv.contractual obligation if any

Major differences between Ind AS 40 & AS 13