It is important to understand how do we calculate and arrive at the figure of Net Worth. In this detailed guide here, you will get to know what actually Net Worth is and how can we calculate it. What are the things that we need to keep in our mind? It can also be a good activity if you can, after reading this write–up, calculate your own Net Worth!

A) Net Worth Definition

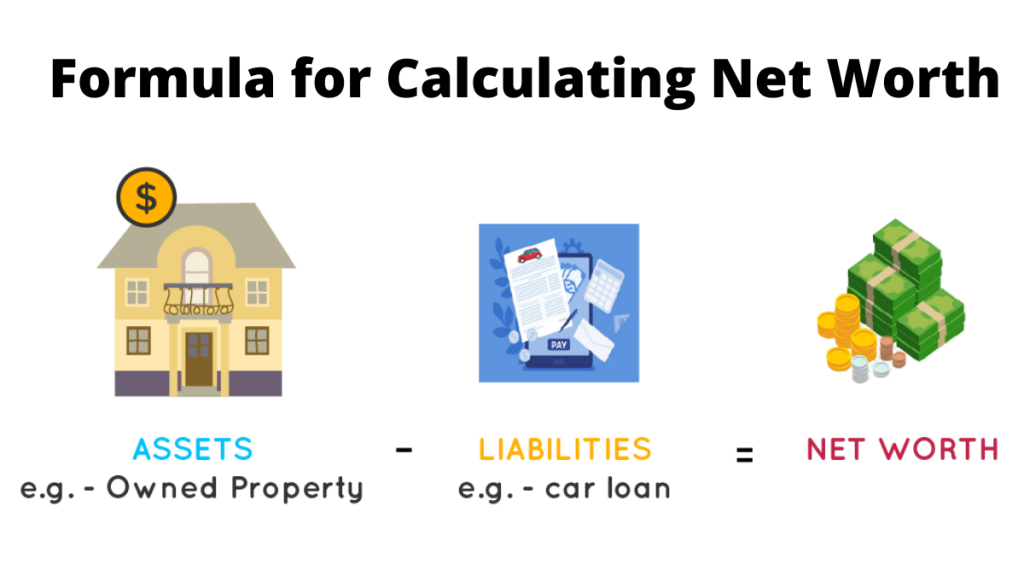

Net worth is simply the difference between the asset and the liability. Net worth is a measure of entity’s worth and hence is also known has owner’s worth or shareholder equity. Net worth can be calculated for an individual, firms or companies, or even countries.

B) What makes net worth?

As per the definition, net worth consists of assets and liabilities. To understand net worth, one needs to first understand assets and liabilities.

C) Assets

Assets are the items which are owned by a person or company. Assets consist of cash and cash equivalents, inventory, plant and machinery, building etc. For calculating net worth, one must first identify the current market value of assets.

D) Liabilities

Liability is an item which is payable by a person or company. Liabilities are the outstanding debts and consist of bank debts, bonds, vendor payments etc.

E) How to calculate net worth

The simple formula to calculate net worth is:

F) Net Worth of a Company

Investors consider a lot many things while considering investment in a company because investors want to understand at what level the company is operating at present, what are the potential opportunities for the company, how the company is valued etc. So it becomes necessary to know what the net worth of the company is. The net worth of a company can be calculated as per the above formula. Net worth will be equivalent to the amount left to be distributable among all the shareholders after all the liabilities are paid off from the sale of all assets valued at the current market price.

G) Net Worth of an Individual

In case of an individual, net worth is the assets such as personal properties that consist of house, cars, jewellery, cash etc. less liabilities such as secured and unsecured loans. Check out Net Worth of Following Top Celebrities

H) Positive and Negative Net Worth

If an individual or a company has more assets as compared to liability, there will be positive net worth. If a company has huge profits which it thinks to retain, it will lead to an increase in net worth. If an individual or a company has more liabilities as compared to assets, there will be negative net worth. If a company has negative earnings or fewer earnings which it thinks to distribute among shareholders, it will lead to decrease in net worth. So, I hope you have clearly understood what Net Worth is. You should always have a target Net Worth in your mind and then design your work life in such a way, that you reach your desired level of Net Worth. Also, you should always ensure that your Net Worth never goes negative! Recommended

Bumrah Net Worth Ravi Shastri Net Worth Rajat Sharma Net Worth Cash Transaction Rules under Income Tax How to carry out Audit of Assets & Liabilities?