Section 139 of GST – Migration of existing taxpayers

Statutory provision (1) On and from the appointed day, every person registered under any of the existing laws and having a valid Permanent Account Number shall be issued a certificate of registration on provisional basis, subject to such conditions and in such form and manner as may be prescribed, which unless replaced by a final certificate of registration under sub- section (2), shall be liable to be cancelled if the conditions so prescribed are not complied with. (2) The final certificate of registration shall be granted in such form and manner and subject to such conditions as may be prescribed. (3) The certificate of registration issued to a person under sub-section (1) shall be deemed to have not been issued, if the said registration is cancelled in pursuance of an application filed by such person that he was not liable to registration under section 22 or section 24. Related provisions of the Statute:

Analysis and Updates

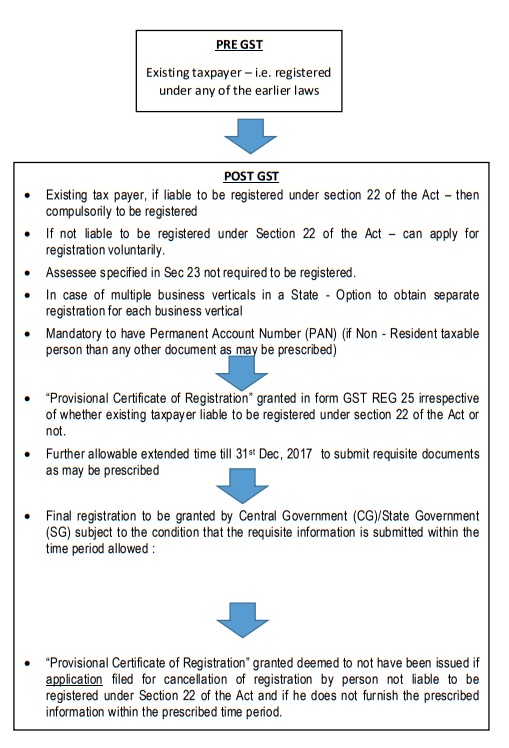

Introduction This transitional provision deals with migration of existing registrants into the GST regime. All existing registrants having a valid Permanent Account Number will be issued provisional registration certificate. After furnishing the required information, a final certificate of registration will be granted. If the information is not furnished, the registration is liable to be cancelled. Analysis As part of implementation of GST regime, the existing tax payers / registrants having a valid PAN would be granted provisional registration certificates under the GST law. The details are as follows:

(i) The existing tax payer, other than a person deducting tax or an Input Service Distributor (ISD), who were registered under various earlier Indirect Tax Laws are liable to be registered under GST Laws with effect from the appointed day, when the relevant sections of CGST Act came in to force. Such taxpayer is required to declare his Permanent Account Number (PAN), mobile number, e-mail address, State or Union territory and shall enroll himself for getting the provisional registration certificate.(ii) On successful verification of the PAN, mobile number and e-mail address, an application reference number (ARN) shall be generated and communicated to the applicant on the said mobile number and e-mail address.(iii) Upon enrolment, the said person will be granted a provisional registration certificate in Form GST REG-25, incorporating the Provisional ID (GSTIN) and Password, which will be available on the GST common portal. (https://www.gst.gov.in/).(iv) A person having a single PAN in a State or UT shall be granted only one provisional registration certificate although he may hold multiple registrations under the erstwhile central and State laws.(v) A person who holds a provisional certificate of registration is required to furnish certain information in Form GST REG-26, within a period of 3 months or as extended by the commissioner. The date was extended till 31.12.2017 vide order No. 6/2017 – GST dated 28.10.2017.(vi) If the information furnished is correct and complete, Final Registration Certificate in Form GST REG 06 will be issued, within 6 months of the appointed day.(vii) If the and/or information has not been furnished or not found to be correct or complete, the proper officer shall cancel the provisional registration and issue an order in Form GST REG-28 cancelling the registration after serving a show cause notice in Form GST REG-27 and affording the person concerned a reasonable opportunity of being heard.(viii) Once the information specified in sub rule 2(c) has been furnished and no notice has been issued under sub rule 3 within a period of 15 days from the period of furnishing of the information, the registration shall be deemed to have been granted and the registration certificate will be made available on the common portal. The SCN issued in Form 27 can be withdrawn by an order in Form GST REG 20, if it is found subsequently, after affording the person an opportunity of being heard, that no cause as specified in the notice exists.(ix) Every existing taxpayer / registrant, who is not liable to be registered under the Act, may at his option, on or before 31st March 2018, 1 file electronically an application in Form GST REG-29 at the Common Portal for cancellation of the registration granted provisionally to him and the proper officer shall, after conducting such enquiry as deemed fit, cancel the said provisional registration.(x) A person to whom provisional certificate is issued and who is eligible to pay tax under composition, may opt to do so by filing electronically an intimation, in Form GST CMP-01 within 30 days after the appointed day, or such further period as may be extended by the Commissioner in this behalf. This period was extended to 16th August, vide Notification no. 1/2017- GST dated 21.07.2017. In case the said person does not file Form GST CMP-01 within the said time lines and if he wants to opt for payment of taxes under the composition scheme under section 10, subsequently during the year 2017-18, he shall electronically file an intimation in Form GST CMP-02 before 31st March, 2018. He can opt to pay tax under section 10 w.e.f. the 1st day of the next month on wards. Such persons shall furnish statement of stock in Form GST ITC-03 within a period of 90 days from the day on which he commences to pay tax under section 10. The above persons who have filed the intimation and statement as above shall not be allowed to file Form GST TRAN-01, after furnishing Form GST ITC-03.(xi) It is pertinent to note here that as per Rule 5(1)(b), the person who prefers to file CMP-01 shall not hold any goods in stock on the appointed day; i. that have been purchased in the course of interstate trade or; ii. imported from outside India, or iii. received from his branch, agent or principal situated outside the state;However, this restriction regarding the holding the stock received from outside the state is not applicable in the case of persons opting to pay tax under Section 10 by filing Form GST CMP-03 (xii) A Special Economic Zone Unit or a Special Economic Zone Developer shall make a separate application for registration as a business vertical distinct from its other units located outside the SEZ.(xiii) Person desiring multiple business vertical registration must also follow the above steps of migrating to GST and then apply for separate registration of the other business vertical. In case one line of business is exempt and another taxable, it is not possible to obtain business vertical registration for the taxable business only and to leave the exempt business from registration and thereby from compliances requirements (including reverse charge). Business vertical registration refers to the ‘subsequent’ registration of a taxable person who is registered in the first place.

Comparative review This provision is broadly comparable to the provisions relating to migration of registrations from the erstwhile Sales Tax to the Value Added Tax at the time of introduction of VAT law, in 2004/2005. Issues / Concerns:

Correction of incomplete/ incorrect migration process: A sizeable number of taxpayers were unable to complete the migration process due to GST portal glitches / IT related issues and some taxpayers have migrated with incorrect data (i.e. instead of Company PAN the Director PAN has been considered for migration) etc. In these cases, assesses have opted for a new registration and the same has been issued towards the end of July 2017 or in the subsequent months. On account of this, input tax credits are unable to be claimed by the assesses till the date of registration. Further, since the returns would be filed only subsequent to the date of registration, the returns would not be filed by such suppliers and the corresponding credits will not be eligible in the hands of the recipients.

MCQs Q1. Should an existing tax payer surrender his registration certificate for obtaining the GST registration?(a) Yes, all registration certificates shall be surrendered;(b) No. Provisional registration is automatic;(c) Migrated to provisional registration only on verification of documents;(d) No. Final registration is automatic. Ans: (b) No. Provisional registration is automatic Q2. Is PAN mandatory for migration to provisional GST registration?(a) Yes(b) No(c) PAN application is sufficient(d) Exempted may be given by the proper officer Ans: (a) Yes Q3. Should the composition dealer under the old law require to obtain final GST registration?(a) Yes, mandatory for all composition dealers(b) Yes, subject to his turnover crossing the threshold under GST(c) No, the old number will continue(d) No, will be governed by old law Ans: (b) Yes, subject to his turnover crossing the threshold under GST Recommended Articles –

GST ScopeGST ReturnGST FormsGST RateGST RegistrationWhat is GST?GST Invoice FormatGST Composition SchemeHSN CodeGST LoginGST RulesGST StatusTrack GST ARNTime of Supply