Make GST Payment Guide

Electronic tax liability register shall be maintained on the Common Portal and all amounts payable shall be debited to the said registerElectronic credit ledger or electronic cash ledgers hall be maintained and any liability paid through these ledgers will be credited to Electronic tax liability ledgerAmount payable to wards TDS/TCS shall be only through electronic cash ledgerExtent of relief given by the appellate authority shall be credited to Electronic tax liabilityEvery claim of input tax credit shall be credited to the Electronic credit LedgerAmount to the extent of the refund claim shall be debited in the Electronic credit ledger / Electronic cash ledger as the case may be. If the refund so filed is rejected, either fully or partly, the amount debited shall be re-creditedChallan will be generated through common portal for purpose of depositing the amount to electronic cash ledger which will be valid for 15 days

Video Guide for making GST Payment

GST Payment Status

Click Here for GST Payment (Create Challan)Click here to Check GST Challan Status

What is Electronic credit ledger?

Electronic credit ledger is a register to be maintained in the common portal of GST for each registered taxable person in Form GST PMT-2 to record input tax credit claimed, utilization, reversal and refund.

What is Electronic cash ledger?

Electronic cash ledger is a register to be maintained in the common portal of GST for each registered taxable person in Form GST PMT-3 to record deposit of tax, interest, penalty and other amounts, utilization thereof and refund.

Manner of payment of Tax

Deposit can be made through

Internet Banking through authorized banks;Credit card or Debit card after registering the same with the Common Portal from authorized bankNational Electronic Fund Transfer (NEFT) or Real Time Gross Settlement (RTGS) from any bank;Over the Counter payment (OTC) through authorized banks for deposits up to ten thousand rupees per challan per tax period, by cash, cheque or demand draft

A temporary identification number generated through the Common Portal for Payment by non-registered Challan Identification Number (CIN) will be generated upon crediting to concerned government account Incase of difficulty in generating of CIN, representation to be made electronically through the Common Portal to the Bank or electronic gateway through which the deposit was initiated Unique identification number (UIN) shall be generated at the Common Portal for each debit or credit to the electronic cash or credit ledger and the UIN relating to discharge of any liability shall be indicated in the corresponding entry in the electronic tax liability register

Online GST Payment Procedure, Tax payment under GST

How do I make the GST payment in pre-login mode?

To make the GST payment in pre-login mode, perform the following steps:

Access the https://www.gst.gov.in/ URL. The GST Home page is displayed.Click the Services > Payments > Create Challan command.The Create Challan page is displayed. In the GSTIN/UIN/TRPID/TMPID field, enter your GSTIN.

Note:

In case UN Bodies, Embassies, Government Offices or Other Notified persons wants to create a Challan in pre-login, they need to provide Unique Identification Number (UIN).In case Tax Return Preparers wants to create a Challan in pre-login, they need to provide Tax Return Preparer Identification Number (TRPID).In case unregistered dealer having temporary ID wants to create a Challan in pre-login, they need to provide Temporary Identification Number (TMPID).

- In the Type the characters as displayed below field, enter the captcha text.

- Click the PROCEED button.

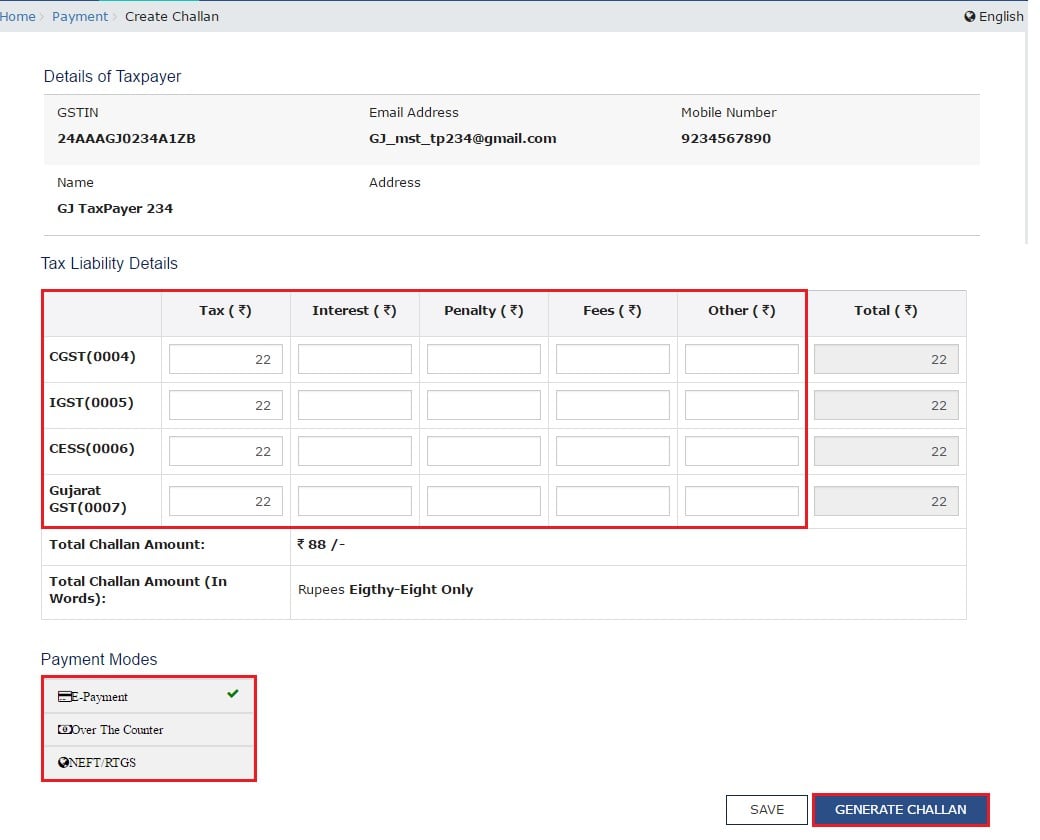

- In the Tax Liability Details grid, enter the details of payment to be made. The Total Challan Amount field and Total Challan Amount (In Words) fields are auto-populated with total amount of payment to be made.

- Select the Mode of E-Payment. In case of E-Payment

a. In the Payment Modes option, select the E-Payment as payment mode.b. Click the GENERATE CHALLAN button.

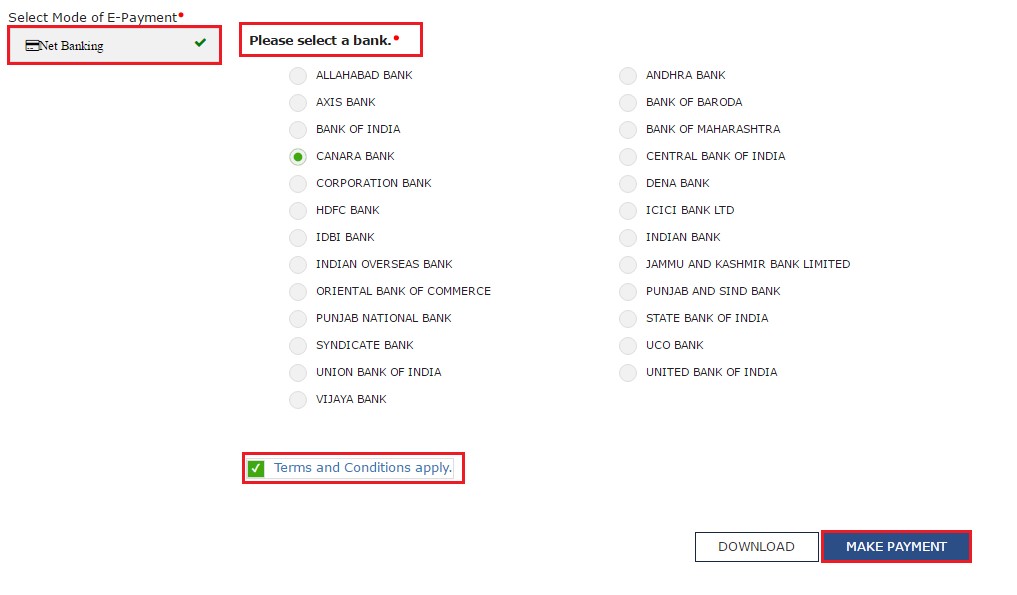

c. The OTP Authentication box appears. In the Enter OTP field, enter the OTP sent on registered mobile number of the taxpayer whose GSTIN/UIN/TRPID/TMPID is entered. d. Click the PROCEED button. e. The Challan is generated. Note: You can also download the GST Challan by clicking the DOWNLOAD button. f. Select the Mode of E-Payment as Net Banking. g. Select the Bank through which you want to make the payment. h. Select the checkbox for Terms and Conditions apply. i. Click the MAKE PAYMENT button Note: You will be directed to the Net Banking page of the selected Bank. The payment amount is shown at the Bank’s website. If you want to change the amount, abort the transaction and create a new challan. In case of successful payment, you will be re-directed to the GST Portal where the transaction status will be displayed. The payment receipt is displayed. To view the receipt, click the View Receipt link. You can also make another payment by clicking the MAKE ANOTHER PAYMENT button. In case of Over the Counter

a. In the Payment Modes option, select the Over the Counter as payment mode.b. Select the Name of Bank where cash or instrument is proposed to be deposited.c. Select the type of instrument as Cash/ Cheque/ Demand Draft.d. Click the GENERATE CHALLAN button.

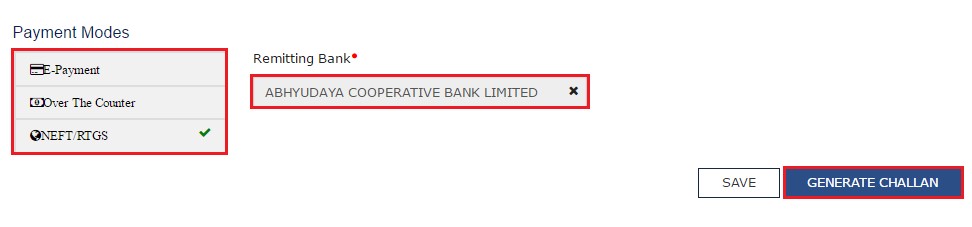

e. The OTP Authentication box appears. In the Enter OTP field, enter the OTP sent on registered mobile number of the taxpayer whose GSTIN/UIN/TRPID/TMPID is entered. f. Click the PROCEED button. g. The Challan is generated. Note: You can also download the GST Challan by clicking the DOWNLOAD button h. Take a print out of the Challan and visit the selected Bank. i. Pay using Cash/ Cheque/ Demand Draft within the Challan’s validity period. j. Status of the payment will be updated on the GST Portal after confirmation from the Bank. In case of NEFT/ RTGS a. In the Payment Modes option, select the NEFT/RTGS as payment mode. b. In the Remitting Bank drop-down list, select the name of the remitting bank. c. Click the GENERATE CHALLAN button. d. The OTP Authentication box appears. In the Enter OTP field, enter the OTP sent on registered mobile number of the taxpayer whose GSTIN/UIN/TRPID/TMPID is entered. e. Click the PROCEED button. f. The Challan is generated. Note: You can also download the GST Challan by clicking the DOWNLOAD button g. Take a print out of the Challan and visit the selected Bank. Mandate form will be generated simultaneously. h. Pay using Cheque through your account with the selected Bank/ Branch. You can also pay using the account debit facility. i. The transaction will be processed by the Bank and RBI shall confirm the same within <2 hours>. j. Once you receive the Unique Transaction Number (UTR) on your registered e-mail or mobile number, you can link the UTR with the NEFT/RTGS CPIN on the GST Portal. Go to Challan History and click the CPIN link. Enter the UTR and link it with the NEFT/RTGS payment. k. Status of the payment will be updated on the GST Portal after confirmation from the Bank. l. The payment will be updated in the Electronic Cash Ledger in respective minor/major heads. Recommended Articles

GST Formats for PaymentGST Tax Payment RulesHow to File GSTR 1How to File GSTR 3GST FormsGST RegistrationGST RatesGST India